Cost Accounting Standard

Cost accounting is an information subsystem within the accounting records system and its primary function is to provide information on costs. It is also a process of recognising, accumulating, transforming, presenting and interpreting cost information which allows the information holder to carry out assessments and make decisions, as well as determine the costs associated with the conducted activities.

Pursuant to Article 31lc(6) of the Act on publicly financed healthcare services, “[t]he healthcare service providers who conclude an agreement on the provision of healthcare services shall apply the cost accounting standard,” with the exception of the those healthcare service providers who:

- are exempt from the obligation to keep full accounting records in line with the Accounting Act of 29 September 1994;

- provide healthcare services exclusively in the field of primary healthcare;

- provide services in the field of supply of medical devices.

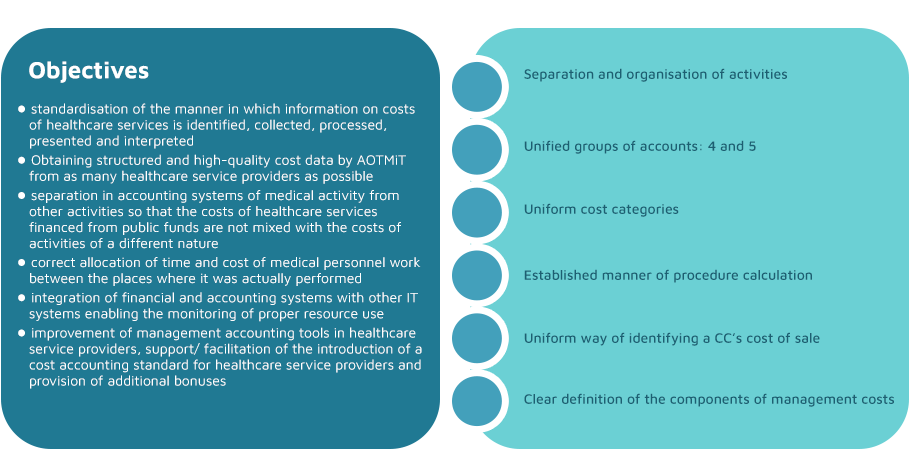

The main objectives of the Regulation:

- organising the healthcare providers’ cost accounting without interfering in individual practices resulting from the specific nature of the healthcare services provided;

- imposing an obligation on healthcare providers to separate medical activities from other activities in their accounting and bookkeeping systems;

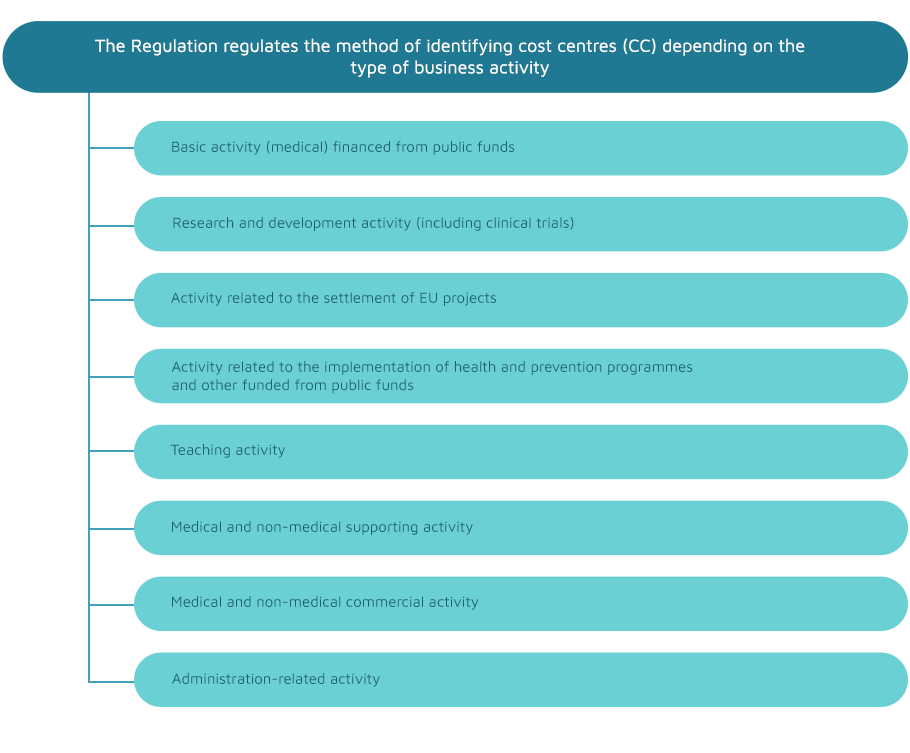

- separating the cost centres (CCs) depending on the type of business activity conducted and the type of healthcare services provided;

- systematising the CCs by assigning a function code and a code characterising the specialisation of the organisational unit, without the need to include them in the account number

- unifying cost accounting by type;

- determining the method of cost allocation by function, along with calculation of the CC production cost;

- determining the procedure pricing methods;

- improving the tariff setting process without imposing detailed solutions which, due to the size of the target users, are characterised by great diversity.

The implementation and use of the cost accounting standard means a uniform way of recording and allocating costs, which translates into the higher quality of the data provided to the Agency for Health Technology Assessment and Tariff System and into a faster tariff setting process. It is also an excellent management tool for cost monitoring in a healthcare entity and comparison with other healthcare providers.

Advantages of implementing the cost accounting standard:

- unifying the method of identifying, collecting, processing, presenting, and interpreting information on the costs of healthcare services – possible benchmarking with other healthcare providers and comparing healthcare entities in terms of economic indicators;

- properly separating cost centres in terms of basic medical activity, auxiliary medical activity, and non-medical activity as well as management – this will allow real allocation of resources to individual cost centres, leading to their effective use;

- distributing cost by type of activity, as resulting from the statutory purpose of the Regulation on the acquisition of information on the costs of healthcare services – each type of activity means separate revenues, so costs should also be broken down by type of activity;

- acquiring management information that helps the Directors/Management make current decisions regarding the allocation of financial resources within units and the preparation of financial and investment plans – obtaining information on profitability for individual cost centres, allowing current analysis of cost structure and dynamics;

- acquiring an effective management and controlling tool for founding bodies and constituent entities;

- improving the process of setting a healthcare service tariff system, which will translate into a measurable economic effect – higher revenues by increasing the pricing of services reported by entities as loss-generating;

- improving the economic knowledge of all employees within the entity – which will result in better awareness and cost-effectiveness of the use of materials, equipment, drugs, etc.

*Ladies and Gentlemen

We inform you that the materials and results of the discussions posted on the Agency’s website are the result of the conceptual work and analytical process carried out by the team of the Agency for Health Technology Assessment and Tariff System based on the EBM paradigm, including: search, selection, synthesis and interpretation of scientific evidence, or the data analysis carried out.

In connection with the above, we would like to inform you that the use of analytical material or the results of the discussion, in accordance with good practice, should be accompanied by information on the source in the form: [title of presentation / report], AOTMiT, Warsaw, June 2024]